A Succession-Track IR Seat at the Heart of European Private Equity

Lead relationships with world-class LPs, shape the next fundraise, and grow into the future Head of Investor Relations at Castik Capital.

Seeking an Investment Manager, Stockholm

As an Investment Manager with Impilo you will get a unique exposure to the world of healthcare investing, working side-by-side with a small, dynamic and outstanding team of investment professionals with backgrounds from private equity, investment banking, consulting, and the healthcare industry.

You will typically be given more responsibility as well as broader exposure to portfolio companies and boards from day one, compared to similar roles at most other PE-firms. Moreover, despite having been off to an exceptionally strong start, Impilo is still a young firm, and you will be encouraged and expected to contribute to the overall shaping and organizational development of the firm.

You will be a core deal team member, gaining exposure to entire investment cycles, including the identification and analysis of a potential investment targets, the due diligence and negotiation process, the company holding and development phase, and finally the exit process. You will work in close collaboration with other colleagues and industrial advisors, driving growth and operational improvements by carrying out business development and strategic projects.

In summary, as Investment Manager at Impilo:

-

You will be involved as a core team member in due diligence and transactions processes, responsible for driving selected workstreams from day one

-

You are expected to conduct independent financial, business and market analysis

-

You are highly encouraged to bring new investment opportunities to the table

-

You will be active in the management of existing portfolio companies and participate in board meetings

-

You will work in close collaboration with Impilo’slarge network of industrial experts across healthcare verticals

-

You will have fun and be part of shaping the firm

The right candidate will have 2-4 years of professional experience from Tier 1 Investment Bank or Management Consulting firm. To be successful in this position you will not only be required to show high analytical capabilities, strong drive and interest in the private equity industry long term, but also have strong integrity and a humble personality.

As Impilo is a small organization, it is crucial to have an entrepreneurial spirit, be a true team player and have a genuineinterest in working with and developing the firm. You also have an interest in healthcare, sustainability and doing good for society.

Requirements

- 2-4 years of experiencefrom a Tier 1 management consulting firm or investment bank

- Genuine interest in healthcare and investments

- Relevant academic degree

- Excellent academic and professional track record

Merits

- Experience from the healthcare sector

Personal characteristics

-

High performer with strong analytical and logical capabilities

-

Result oriented and perseverant

-

Easy to interact with, strong interpersonal skills

-

High level of integrity and trustworthiness

-

Dedicated and proactive

-

Self starter

-

Secure and humble

Investment Experience from more than 35 completed healthcare transactions and board experience from more than 65 healthcare companies

Impilo is an investment company focused solely on investments in Nordic companies operating in the pharmaceutical, medical technology, healthcare services and other health-related industries.

Our starting point is that our portfolio companies must contribute to the positive and sustainable development of the communities and markets in which they operate in order to remain successful in the long term.

This is a conviction that is embedded in our investment strategy since it necessitates a deeper understanding and reduces risks. In this way, Impilo invests in people’s opportunities to enjoy healthier lives in the future.

Focus on investments with enterprise value of EUR 50–200m with potential for larger investments together with co-investors

Companies active in the full spectrum of healthcare industries, including pharma, MedTech, healthcare services, consumer health, care services and digital healthcare

Healthcare sector specialist with Impilo at Glance

Primarily majority ownership in unlisted companies, but have the flexibility for minority, or controlling publicly listed stakes

Operational since

Secured in total commitments

since inception

Investment professionals

Offices (Stockholm and Copenhagen)

Portfolio companies

Gross IRR since inception

Diversified & Experienced Team

Stockholm

6

2

2

1

1

4

2

18 employees

Average age: c. 37 years old

Copenhagen

1

1

1

2

1

6 employees

Average age: c. 34 years old

Partners

Investment Directors

Senior Investment Managers

Investment Managers

Investment Analyst

Student workers

Other

18 employees

Average age: c. 37 years old

6 employees

Average age: c. 34 years old

Investment team experience

Years of experience by type, % of total

Gender balance

Gender split, %

Team commitment

Team commitment in pool 2 equals over 500 MSEK (close to 10% of total) and a roll-over of value from pool 1 that equals 250 MSEK1

Fredrik Strömholm

CEO/Partner

Impilo since 2017

Experience

>20 years in PE; Cofounder at Altor 2003- 2016, 10 years at Goldman Sachs, 4 years at Nordic Capital

Jesper Eliasson

CFO/Partner

Impilo since 2017

Experience

>20 years in PE; Altor CFO 2003–2015 and IK 1996–2003

Board member SVCA 2009–2015

Magnus Edlund

Partner

Impilo since 2017

Experience

14 years in PE incl. 9 years at Altor; 5 years consulting at BCG

Martin Fagerlund

COO/Partner

Impilo since 2018

Experience

5 years in PE, 12 years as a lawyer at MSA 2006-2016 (incl. secondments at Altor & Ericsson), AFH 2016-18

Nicholas Hooge

Partner

Impilo since 2020

Experience

15 years in PE; 13 years at EQT Partners in Copenhagen and New York and 2 years at Deutsche Bank’s Nordic M&A team in London

Victor Steien

Partner

Impilo since 2018

Experience

4 years in PE; 10 years in Investment Banking with 7 years at Goldman Sachs in London and 3 years at Morgan Stanley in Stockholm

Carolina Oscarius Dahl

Partner

Impilo since 2023

Experience

7 years in PE at IH Long-Term Equity Advisors and Nordstjernan and 8 years consulting at McKinsey

Fredrik Odin

Director

Impilo since 2017

Experience

7 years in PE and 2 years in Investment Banking, with 2 years at XIO Group and 2 years at BAML

Gustav Jungdalen Lundgren

Director

Impilo since 2017

Experience

5 years in PE, 5 years at ABG

Svitlana Babak Andersen

Director

Impilo since 2017

Experience

5 years in PE and 9 years consulting incl. 6 years McKinsey Healthcare practice, 3 years Roland Berger

Edvard Hubendick

Senior Inv. Manager

Impilo since 2019

Experience

3 years in PE and 2 years at McKinsey & Company incl. 1 year of HC projects

Frederikke Beck

Senior Inv. Manager

Impilo since 2023

Experience

2 years in PE and 3 years at KIRKBI and 1 year at JP Morgan

Henrik Nielsen

Senior Inv. Manager

Impilo since 2021

Experience

2 years in PE and 2 years at BCG’s Scandinavian Principal Investors and Private Equity team

Matilda Hessedahl

Investment Manager

Impilo since 2021

Experience

2 years in PE and 2 years at BCG’s Scandinavian Principal Investors and Private Equity team and Healthcare Team

Alexander From

Investment Manager

Impilo since 2022

Experience

1 year in PE and 3 years at FIH Partners in the M&A and IPO advisory team in Copenhagen

Olga Court-Payen

Investment Manager

Impilo since 2023

Experience

2 years in PE and 1 year at Carnegie

Paula Johansson

Investment Analyst

Impilo since 2022

Experience

Joined Impilo in 2022 as an intern and starting fulltime in 2024. Paula holds a BSc in Business & Economics at SSE and MD from Karolinska Institute

Malin Sundqvist

Director of Finance

Impilo since 2023

Experience

8 years at KPMG in the transaction services team in Stockholm

Our Mission & Values

Investing in a healthy future

We invest in a healthy future. At the core of this bold statement lies our belief that long-term investments with positive health impacts will lead to superior returns, for society as well as for investors.

Impilo is an investment company focused on companies, primarily in the Nordics, operating in the full healthcare universe, including businesses within pharmaceuticals, MedTech and healthcare services.

Our investment strategy focuses on identifying businesses with great potential for long-term, profitable growth and positive health outcomes.

At the core of our investment thesis lies our

belief that investing in healthcare businesses with positive health outcomes, strong ESG perfor- mance and high growth potential will create better companies that can deliver higher returns. Hence, when we make new investments, we consider the current and potential health impacts of a business alongside commercial and financial criteria.

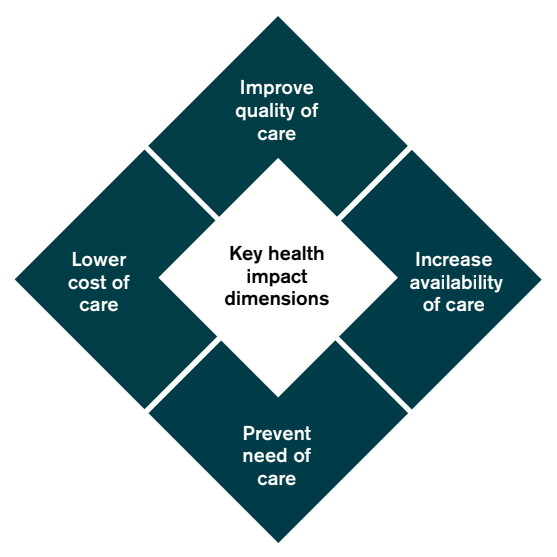

The Impilo Health Diamond

The Impilo Health Diamond represents our four main investment criteria. Any new investment must align with or have the potential to align with one or more of the criteria of the Impilo Health Diamond to be deemed attractive. Ultimately, we believe that healthcare companies with attractive solutions that either improve the quality of care, increase the availability of care, lower the cost of care or prevent the need of care make for attractive investment prospects.

Impilo’s Sustainability Framework

At Impilo, we are on a mission to invest in and build leading healthcare companies. We consider sustainability a central component of this commitment and believe that the leading healthcare companies of tomorrow are also the most sustainable healthcare companies. Our efforts are guided by our mission and our three core commitments:

Our Core Sustainability Commitments (What we want to achieve)

Three core commitments

Accelerate positive health impacts

- Identify new investments with a positive health impact

- Work with portfolio companies to assess, measure and accelerate positive health outcomes

Manage ESG risks and opportunities

- Ensure effective mitigation of ESG risks during investment and ownership

- Identify value creation opportunities on material ESG topics during investment and ownership

Manage ESG risks and opportunities

- Measure performance and progress on material health impact and ESG dimensions during our ownership